How do you tell your boss they’re wrong?

Sooner or later, you’re going to disagree with your manager.

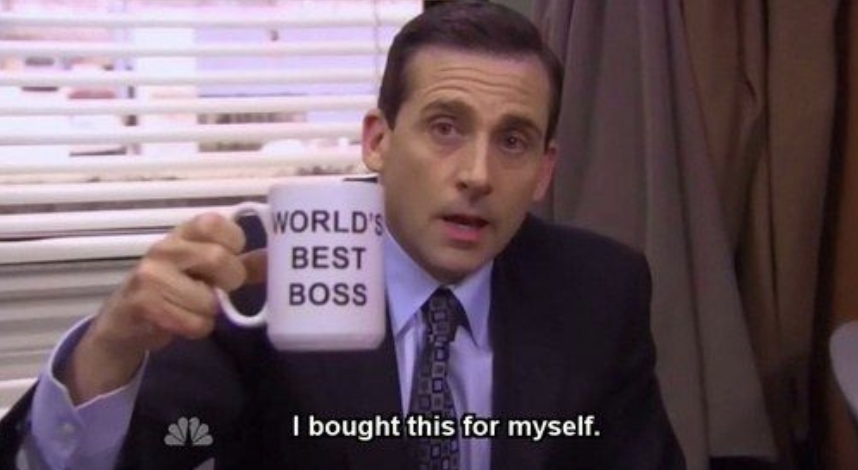

Imagine that you’re in a “data driven” company. It has 3 or 4 analytics tools so it can put the right tool on the problem. But, the weird thing is that your boss doesn’t believe the data. Sure, he believes most of the data. Actually, he believes the data that matches his preconceived notions. He’s old school. He repeats the mantras, “If you’re not keeping score, it’s only practice.” He trusts his gut more than data he’s presented. He’s been in the business for a hot minute. He’s come up through the ranks and has seen his share of bad data in his time. To be honest, he hasn’t had “hands-on” for quite some time now.

So, let’s get specific. What you need to present to him is output from a simple SQL query that shows activity in your ERP. Your objective is to demonstrate business value by showing the number of users and what they’re accessing. It’s not rocket science. You’ve been able to query some system tables directly. Your boss happens to be the CIO and he is convinced that nobody is using the system and usage is going down. He expects to use that data point to adopt a new analytics application to replace an existing one because people “just aren’t using it”. The one problem is, people are using it.

The challenge is that you need to present to him data that goes directly against his suppositions. He’s not going to like it, for sure. He may not even believe it. What do you do?

- Check your work – Be able to defend your conclusions. It would be embarrassing if he were able to cast doubt on your data or your process.

- Check your attitude – Make sure that you’re not presenting data antithetical to his assumptions just to nail him to the wall. That may be gratifying – fleetingly, but it wont help your career. Besides, it’s just not nice.

- Check it with someone else – If you have the luxury of being able to share your data with a peer before you present it, do it. Have her look for flaws in your logic and poke holes in it. Better to find an issue at this stage than latter.

The Hard Part

Now for the hard part. Technology is the easy part. It’s reliable. It’s repeatable. It’s honest. It doesn’t hold a grudge. The challenge is how do you package the message. You’ve done your homework, present your case. Just the facts.

Chances are good that during your presentation, you’ve been watching him out of the corner of your eye to look for clues. Clues that tell you, perhaps, how open he is to your message. Non-verbal clues may tell you that you should walk away or maybe even run. In my experience, it is rare, in this situation, that he will say, “you’re absolutely right, I’m sorry. I missed the mark completely. Your data disprove me and it looks incontrovertible.” At the very least, he needs to process this.

Ultimately, he is the one who is responsible for the decision. If he doesn’t act on the data you have presented, it’s his neck on the line, not yours. Either way, you need to let it go. It’s not life or death.

Exceptions to the rule

If you’re a nurse and your boss is a surgeon who is about to amputate the wrong foot, you have my permission to stand your ground. Especially if it’s my foot. Believe it or not, though, Johns Hopkins says it happens over 4000 times as a year., Bosses, or surgeons, are generally deferred to and given the benefit of the doubt. Ultimately, the well-being of the patient is the doctor’s responsibility. Unfortunately, senior surgeons (like any boss) have different levels of openness to input from other operating theater staff. One study found that the key recommendation for improving patient safety in the operating room was improved communication.

Similarly, there is often a hierarchy in the cockpit and there are stories with disastrous consequences when the copilot failed to call out his boss on questionable decisions. Pilot error is the number one cause of airplane accidents. Malcolm Gladwell, in his book, Outliers, relates an airline that was struggling with a poor record of crashes. His analysis was that there was a cultural legacy that recognized hierarchies even among workplace equals when there was a disparity in age, seniority or sex, for example. Because of this deferential culture of some ethnic groups, pilots did not challenge their perceived superior – or in some cases the ground controllers – when confronted with imminent danger.

The good news is that the airline worked on that specific cultural issue and turned its safety record around.

Bonus – Interview Questions

Some HR managers and interviewers are fond of including a question supposing a scenario like the one described. Be prepared to answer a question like, “What would you do if you disagreed with your boss? Can you give an example?” Experts suggest keeping your response positive and not disparaging your boss. Explain how it is a rare event and you don’t consider it personal. You might also consider explaining to the interviewer your process prior to the conversation with your boss: you check and recheck your work; you get a second opinion; you present it as you found it, make your case, let the facts speak for themselves and walk away..

So

So, how do you tell your boss he’s wrong? Delicately. But, please do it. It may save lives.