The Dream of a Single Analytics Tool is Dead!

There’s a persistent belief among business owners that an entire firm needs to operate on a single business intelligence tool, be it Cognos Analytics, Tableau, Power BI, Qlik, or anything else. This belief has resulted in billions of dollars lost as firms scramble to force their various departments to move software. The business world is just now waking up to a better solution – combining multiple BI tools into one single space.

How Many BI tools are in Concurrent Use?

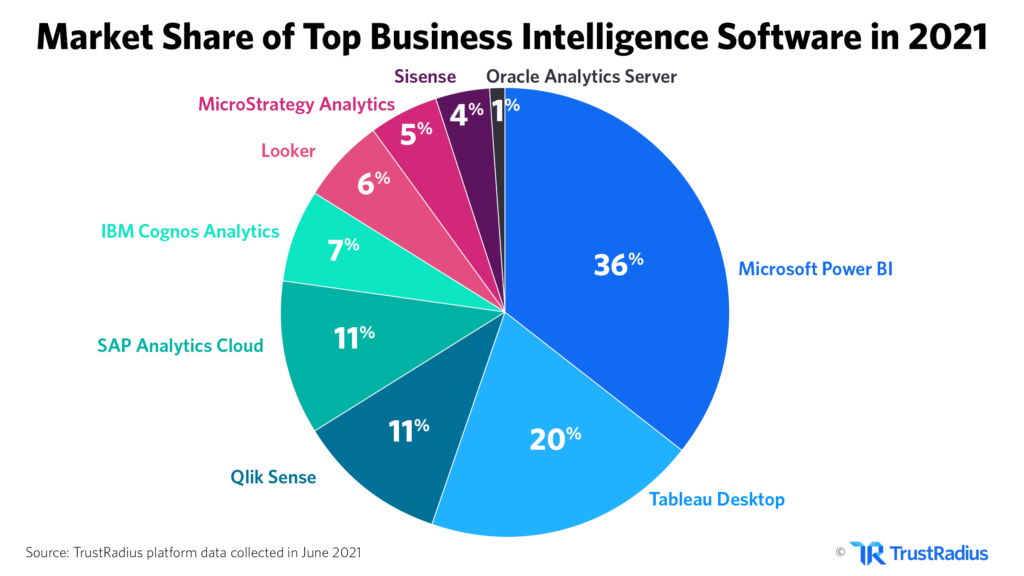

If you were to investigate what the most common and widespread BI tools were across all industries, the answer would almost certainly not be the biggest names in the space. That’s because of one central fact:

Analytics are everywhere.

Point of Sale systems occupy every retail space in the country. Any firm that has employees has some software that manages payroll. Sales reports are almost universal. All of these constitute examples of BI software, and are far more omnipresent than any relatively sophisticated tool.

With this in mind, it’s easy to see how it’s already the case that multiple BI tools are being used within a single company in every firm in the world.

While this fact has been recognized for decades, it’s often been seen as a hurdle to be overcome. We raise the question – is this the best framing?

The Myth

Contrary to the popular belief that the coexistence of multiple BI tools poses some great hurdle to the progress of high quality analytical output, it is in fact the case that there are many ways in which multiple tools being allowed concurrent use comes with numerous serious benefits.

If you give your disparate departments the liberty to select the best software for their needs, then they can independently home in on the more precise tool for their highly specific needs. For instance, the software that best manages and processes payrolls is unlikely a great tool for managing mass amounts of POS data. While both of these things fall under the umbrella of BI, they’re fundamentally different tasks.

This is a simple example, but you can find many other cases across departments and industries. Analytics is a highly complex undertaking, and different types of data demand different types of treatment. Allowing your employees to find the best fit for their needs is likely to result in a better outcome, both in terms of quality and efficiency of analysis.

In other words, you’re never going to find a single piece of software that can handle all of the idiosyncratic, multifaceted needs your company has.

If it Ain’t Broke…

For many businesses, the status quo (using multiple different analytical platforms) is already working great. Trying to push everybody onto one service is a misguided attempt to streamline analytics and bring greater efficiency.

For an analogy, let’s imagine a company operating in an office that has some unfortunate quirks. The floor plan is a little awkward, the air conditioner is sometimes overzealous, and there’s no pedestrian covering between parking and the building’s entrance, meaning sometimes you have to walk in the rain.

In an effort to make things easier for all the employees, the leadership decides to move spaces to somewhere nearby. The new office is the same size, and it isn’t cheaper. The only impetus to move is to remedy some of the annoyances that the employees have, annoyances that may present a legitimate drain on productivity.

This move will cost tens of thousands of dollars and weeks to months of time, not to mention the more immediate loss in output during and immediately after the move. Additionally, the new space will almost certainly come with its own quirks and annoyances that over the years will start to seem more and more annoying, especially considering the cost of having moved.

If the company had just employed some measures to make their old space work a little better, then all this wasted time and money could have been avoided.

That’s essentially the case here. Various actors in the BI space are working to make the current, slightly awkward situation better, rather than continuing to inflict costly and questionably worthwhile attempts to move onto one single analytics tool.