As a Cognos modeler I’m sure many of you have had this experience: After your latest round of model updates, you publish a new version of a package from Framework Manager. This new version of the package accidentally breaks a ton of reports.

Let’s face it – this is pretty easy to do (especially for reports you haven’t thought about in a while).

Wouldn’t it be nice if you could press a button and batch validate all Cognos reports which are associated with this package…?

Well, you’re in luck because MotioPI (the FREE tool for Cognos admins) allows you to batch validate Cognos reports with just a few simple clicks. Here’s how:

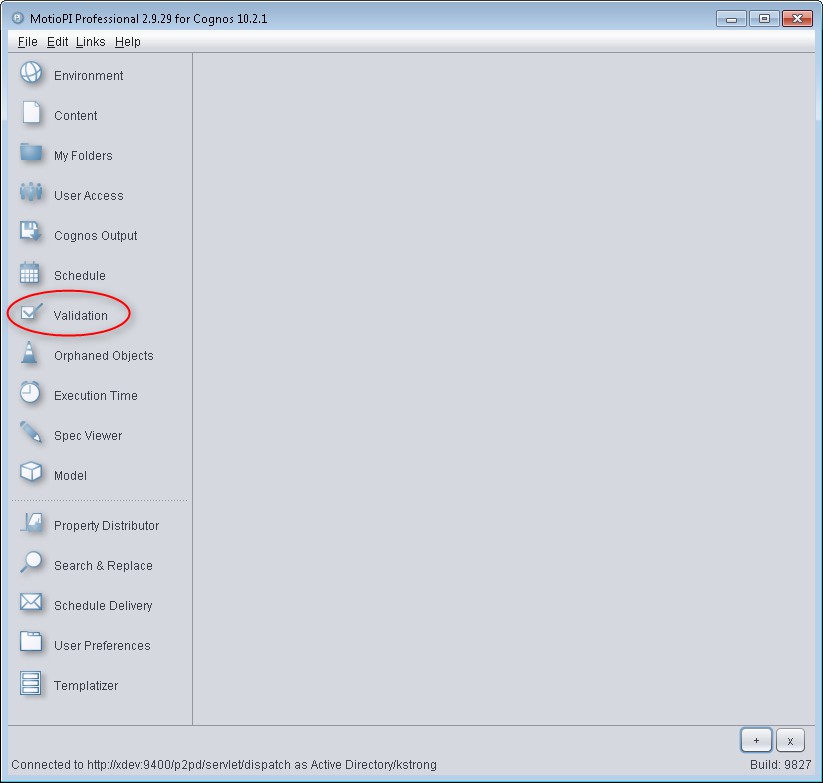

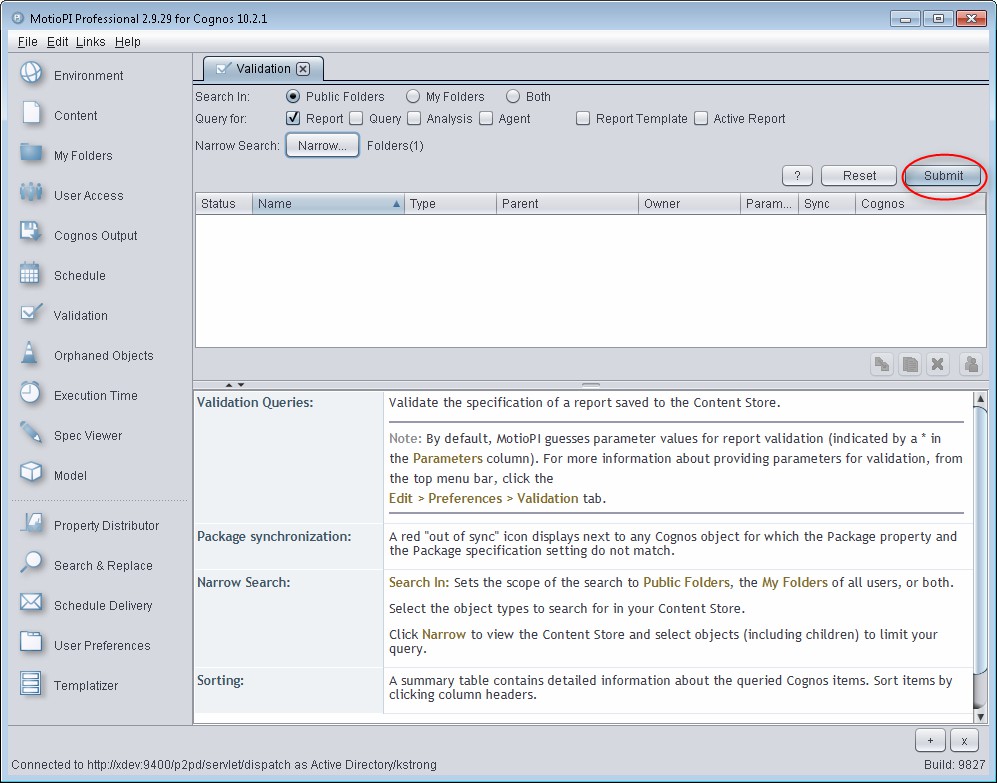

1. First launch MotioPI, login to your desired Cognos Environment, and click on the Validation Panel.

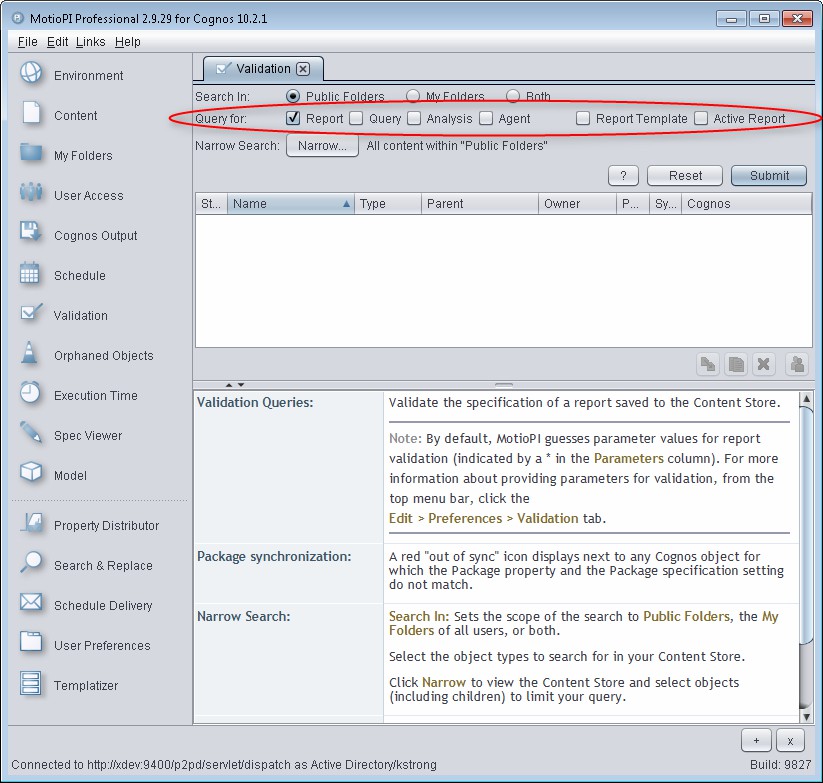

2. Now, we’ll select the type of objects we want to validate (in this example, we’ll stick to validation of reports).

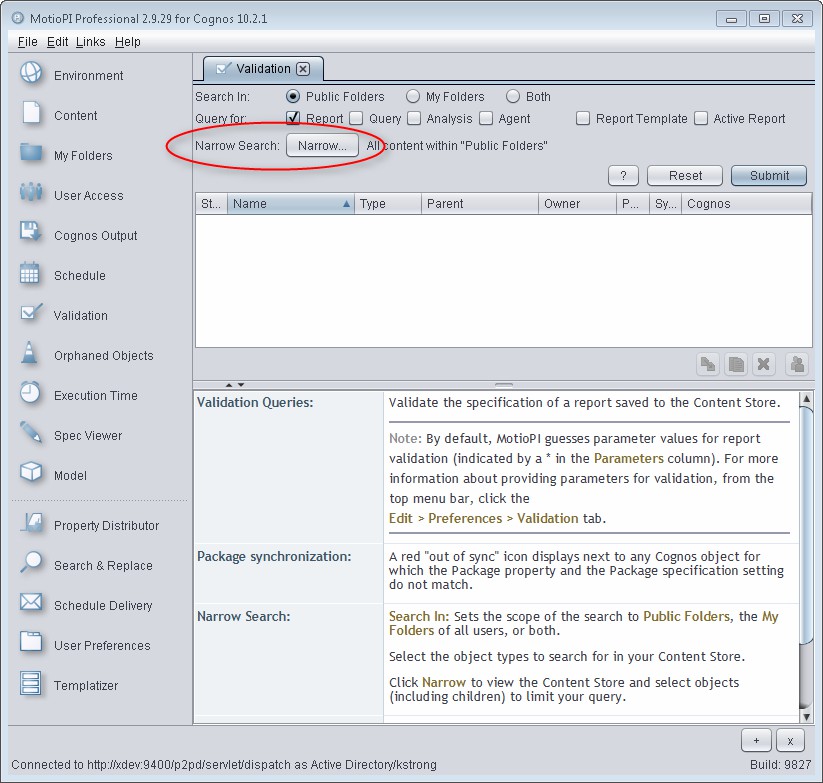

3. Now we’ll specify which reports we want to validate. Click on the Show Cognos Selector button.

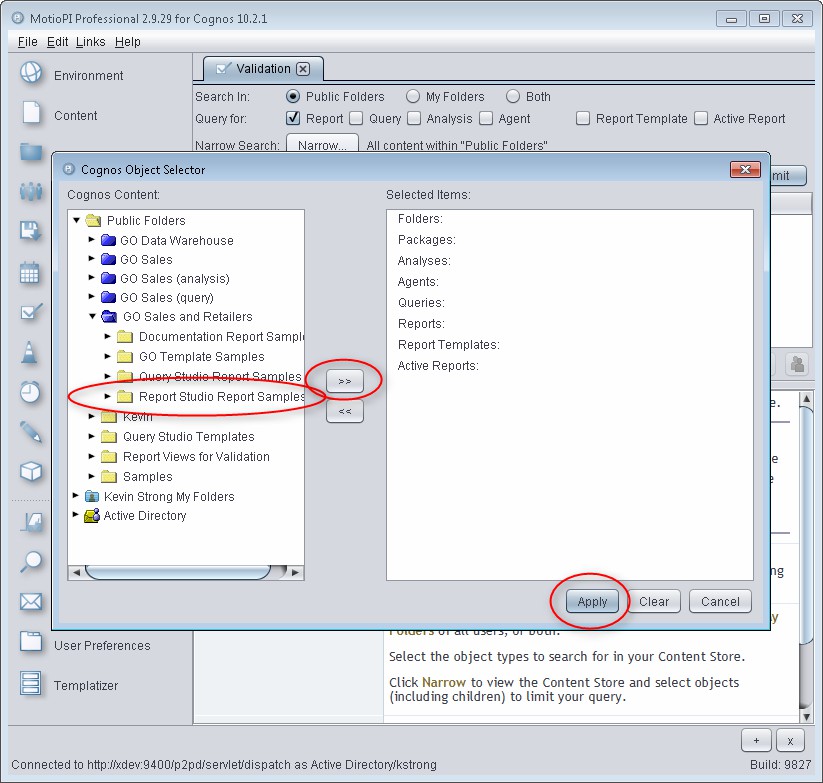

4. Select the folders which contain reports we wish to validate, add them to the right and press apply.

5. Click the submit button to start the validation process. At this point, MotioPI will go off, query for all Cognos reports which match your selection criteria, and then start validating them. Depending on how many reports you selected, this might take a few minutes (could be a good time to grab that next cup of coffee).

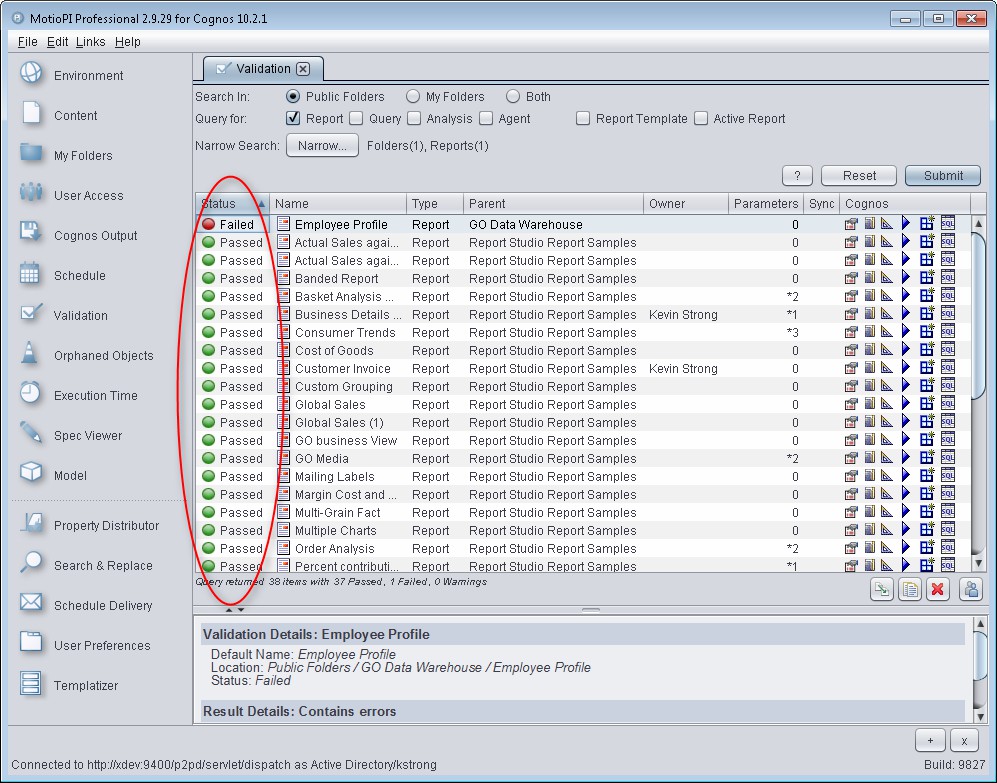

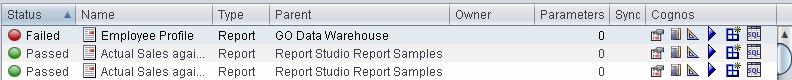

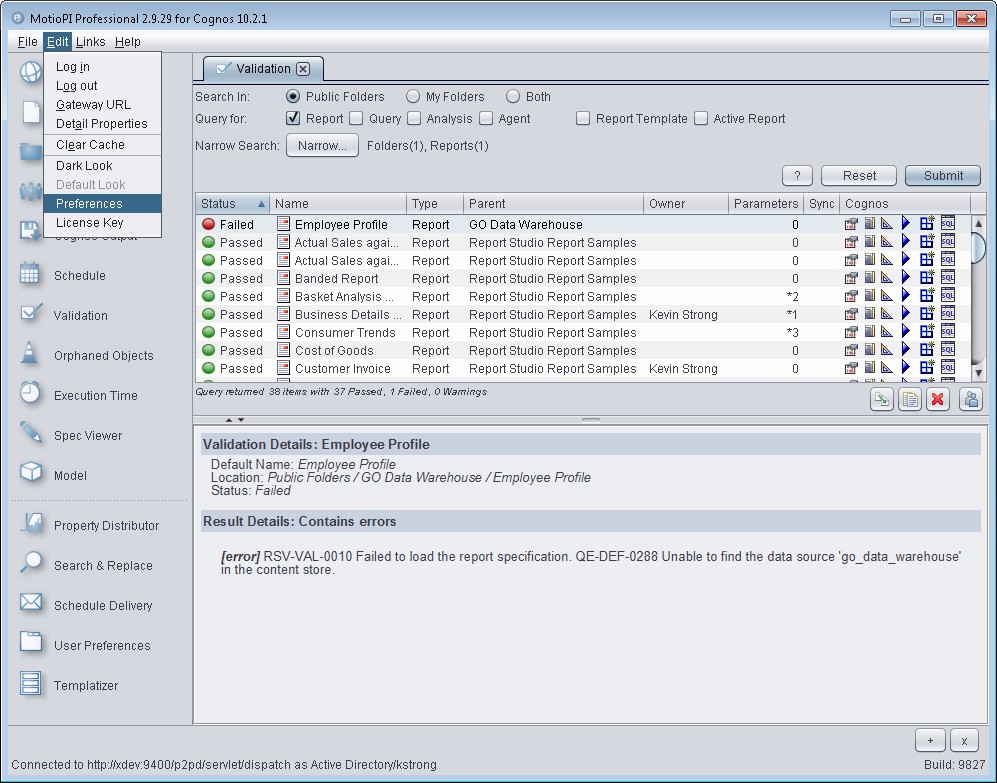

6. As the process runs and the reports are validated, the results will show up in the center panel (shown below).

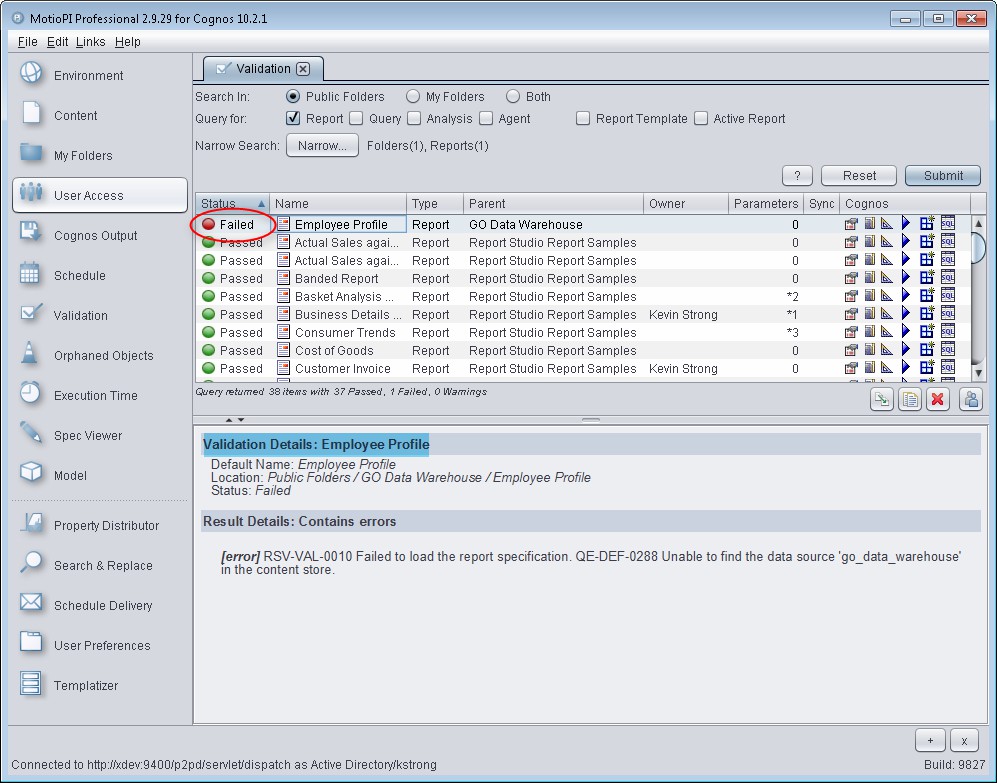

7. For reports which fail validation, you can select the report and view the details in the bottom panel (shown below).

Note that you also have Cognos related actions which can be performed on each validated report. These are shown under the “Cognos” columnn in the results table. Examples of these actions include:

- View the SQL generated by each of the report’s queries

- Open the report’s properties page in Cognos Connection

- Open the report’s parent folder in Cognos Connection

- Launch the report in Report Studio

- Etc.

That’s about it for batch validation of Cognos reports using MotioPI (pretty easy, right?).Advanced usage – custom validation parameters

Many Cognos reports accept required or optional parameters when executed. For parameterized reports, Cognos will prompt for parameter values during validation.

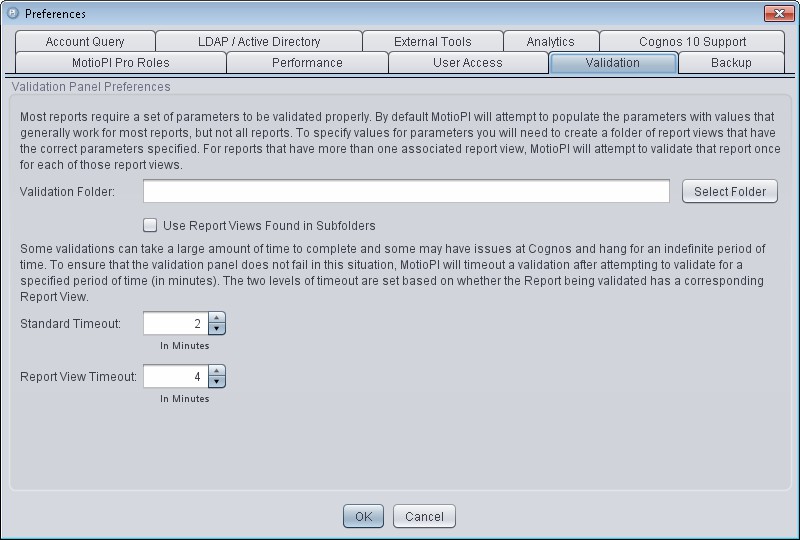

Through introspection, MotioPI can determine which parameters a report accepts (as well as the parameter type), and will pass sample parameter values of the correct type during the validation phase. If you’d like more control over the parameter values which are used during the validation phase, then you can point MotioPI at a set of Cognos report views. This is done through the validation preferences, as depicted below:

1. Open the MotioPI preferences panel, by choosing the Edit -> Preferences menu item

2. Click on the validation tab, and configure which folder contains the aforementioned report views.

{{cta(‘d474175e-c804-413e-998f-51443c663723’)}}

{{cta(‘d474175e-c804-413e-998f-51443c663723’)}}MotioPI, is a free community driven tool for Cognos Admins, Authors and Power Users. Through the support of tools like MotioPI and MotioCI, Motio is firmly committed to improving the efficiency and productivity of Cognos BI teams. If you have ideas for new features you’d like to see in MotioPI, please drop us a line viapi-support AT motio.com.