Some critics suggest that she is driving up Super Bowl ticket prices

This weekend’s Super Bowl is expected to be one of the top 3 most watched events in television history. Probably more than last year’s record-setting numbers and maybe even more than 1969’s moon landing. Why?

Why is the 2024 Super Bowl so popular?

What factors affect the broadcast and streaming viewership of the Super Bowl? Why is it so popular?

- Latinos. Growing popularity in the Spanish-speaking world — the Spanish audience tripled in 2022.

- Taylor Swift. Taylor Swift will be at the game. Some viewers who normally don’t watch the Super Bowl will be tuning in to see the pop star. Millions of others will participate in the Taylor Swift drinking game. Because she’s there.

- Rebound. Super Bowl viewership, and much of broadcast TV, took a hit in 2021. Now it’s rebounding.

- The commercials. Believe it or not, some people tune in just for the ads. Companies that can outlast the bidding war roll out their best.

- The halftime show. The halftime show is always a huge extravaganza. Some will tune in for Usher. Others may step out to refresh their drinks.

- Parties. The Super Bowl is a February reason to have a party. If you attend a Super Bowl function and the TV is on, I’m pretty sure Nielsen counts you as having “watched” the game.

- The Teams. Teams who have a strong regular season draw tend to have higher viewerships. More popular matchups, better games, draw more eyes.

- The Super Bowl. Just by being the Super Bowl. It has developed a reputation. There’s a trend, and it shows no signs of letting up. If half the country sees the game, you’re going to want to be in that half. Someone is going to ask you about it.

There’s a lot going on here. Taylor Swift is a factor. As you can see, there are other, probably more important factors at work contributing to the popularity of the big game. The popularity of the game is also directly related to the ticket prices for the game.

What affects the cost of a Super Bowl ticket?

Many of the same factors that affect the contest’s popularity also affect the cost of attending the Super Bowl in person.

- Inflation. The value of a dollar and the general economy impact discretionary spending.

- Supply and demand. This is Economics 101. When an event is more popular, prices are up. For all of the reasons above, this year’s game is popular, including Taylor Swift. There is also evidence that the NFL and stadiums may affect the supply of tickets. Modern stadiums have more “prime” seating. Again, economics, they’re trying to maximize the revenue of a limited commodity by offering additional amenities. There’s no such thing as the “bleachers.”

- Teams. Historically, popular teams have drawn higher ticket prices. The Cowboys, Brady’s New England Patriots, and the Pittsburgh Steelers have strong fan bases who will travel anywhere to see their team play.

- Celebrities in attendance. Yes, this may have an impact. My guess is while she may show up on the jumbotron at some point, you’ll have a better chance of seeing Taylor Swift if you stay home and watch the game. If other people think the same way, this will affect ticket prices far less than TV viewership.

- Scalping. Unlike watching the game, the secondary market demand contributes to the cost of getting into the Super Bowl. The face value of a ticket is one thing; actually getting your hands on a ticket is another. Because tickets are in demand, most people will need to pay a premium to get in the game.

- Demographics. Affluent, middle-aged male business professionals who are fanatics. Demographics are shifting and becoming more diverse. The sport is consciously trying to engage younger audiences, more women and more international fans. Bottom line: The demographic attending the game does have a significant amount of disposable income.

So, again, I think the Taylor Swift effect is minimal. Most people have other reasons for attending the game. However, she is the model for the new demographic that the Super Bowl is attracting: Young and female with money.

The New Demographic of Super Bowl Attendees

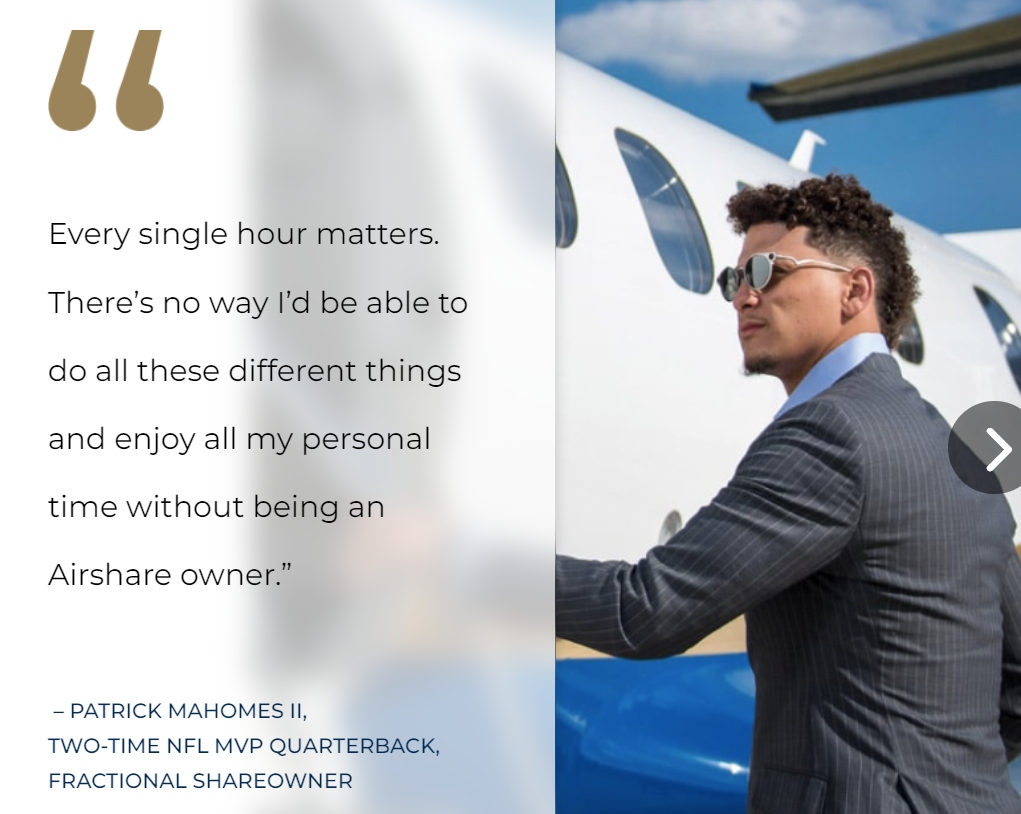

Rule 1: You have to have money. I once looked into fractional jet ownership. I had read that it was actually an affordable way to travel. You set your own itinerary. You travel when you want. There is a no-fuel surcharge option. Some programs allow you to buy a certain number of days of travel. Simple. No-nonsense pricing.

Well, the fractional jet ownership industry’s definition of “affordable” was not the same as mine. Granted, it is less than buying the plane and hiring the pilots. But even fractional ownership isn’t for the common man. Patrick Mahomes II happens to be a customer. Mahomes will make north of $45 Million this year. Strike that. That’s just for the season, not the whole year. Like a school teacher, he can work in the off-season, too.

Speaking of Mahomes, he’ll be in Las Vegas this coming weekend. The Kansas City Chiefs take on the San Francisco 49ers in the 2024 Super Bowl. He’ll probably have to fly on the team jet. But get this: they’re expecting jet parking to be at capacity! In and around Las Vegas, there are a total of 475 parking spots, and they’ll all be occupied. Part of the problem is that there are fewer than half the 1,100 spots that were available for last year’s Super Bowl in Phoenix. Some of the airports will charge up to $3,000.

One option for private jets would be to fly into the most convenient airport in Vegas, drop off the celebrities, and then go park somewhere else. Like Phoenix or somewhere in the Mohave desert. This is exactly what Taylor Swift will probably do before she heads to a suite at Allegiant Stadium. Suite: $2 million, give or take. “Premium food and beverages” for 22 – 26 people are included. That’s $90,909 per person. Do you tip on the full $2 million or just on the food and drink?

There are other less expensive suites. It looks like they’ve rebranded some of the obstructed view seating as an “End Zone Suite.” It includes 25 tickets and parking, but not the food and drink.

It’s too late for this year, but if you want to watch the game from one of the suites, you need to cozy up to one of these companies that are paying the big bucks and renting the suites. Or, Taylor Swift. There’s no debate that the Super Bowl is an expensive date. Taylor Swift has been accused of driving up ticket prices this year. The argument is that she’s famous and is dating someone on the field. Hmm. Compelling, right? She has also been accused of witchcraft and Satanism. So. Whose side are you on?

Who can afford Super Bowl Tickets?

Super Bowl Tickets are more expensive than they’ve ever been. But, then again, so are a lot of things. I think Taylor Swift is getting a bad rap. It’s called capitalism. What the market will bear and all that. This is Vegas, baby. I’ll show you a good time, and you can leave it in Vegas.

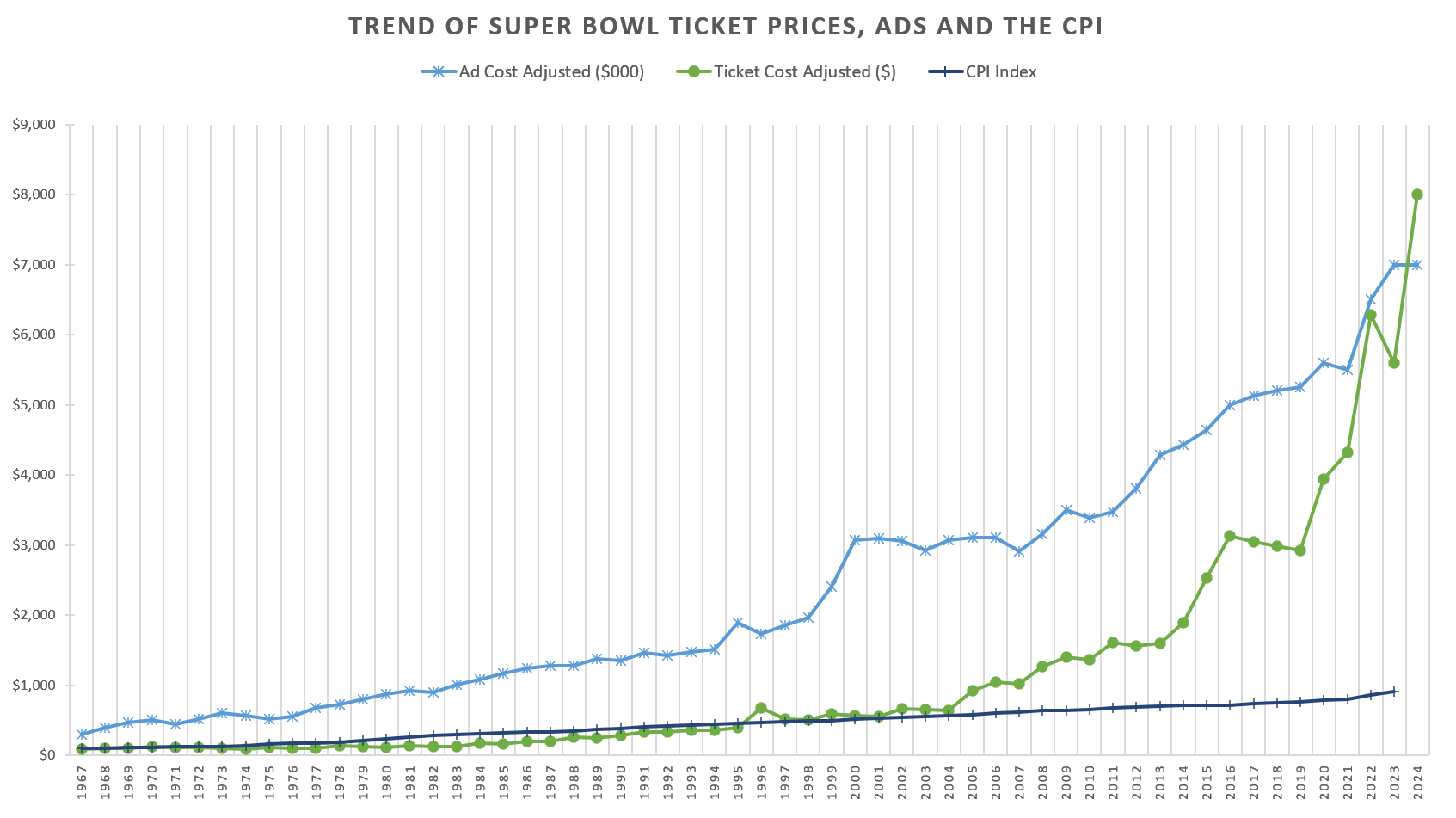

I analyzed the price of Super Bowl tickets and compared it to the price of a 30-second commercial during the game and the Consumer Price Index for the same period. All have gone up. The cost of an ad has consistently outpaced inflation. The price of a Super Bowl ticket, however, followed the price of money until 2005, when it started outpacing inflation. With a couple of dips for a recession and the pandemic, prices have been up year-over-year.

Football is no longer the great American pastime where you take your family of four. Disneyland would be cheaper. No, the Super Bowl is now a game for the rich and famous. The NFL doesn’t care if you can’t afford it. Stay home and watch the game. Heck, they’ll make money on that, too. It is predicted that there will be more eyes on the Super Bowl game-time ads than at any time in the past. Demand for the game is off the charts.

If you think tickets for the game are expensive, just try to get a 30-second spot during the game. It will set you back about $7 million this year. Tickets for both the big game and costs for an ad have climbed steeply. I haven’t heard Taylor Swift being blamed for the high ad costs, but then again, it’s still early.

Some Things are Priceless

I can think of two: A Taylor Swift friendship bracelet and being able to host your friends at the Super Bowl.

| Cost to take 23 of your closest friends to the Super Bowl | |

|---|---|

| Private jet transportation from Dallas or Chicago to Las Vegas without having to worry about parking your jet | $22,500 |

| A suite at the big game with unlimited beer and unlimited hot dogs | 2,000,000 |

| Official NFL souvenir jerseys for 24 | 3,600 |

| Being able to avoid the long line at the ladies’ room | Priceless |